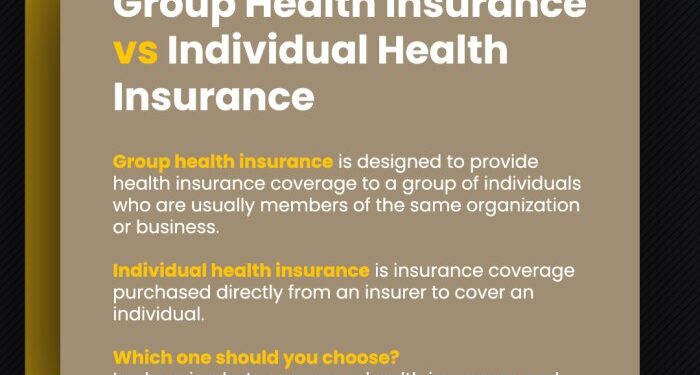

Exploring the realm of Small Business Health Insurance Group vs Individual Plans opens up a world of crucial decisions for business owners. This comparison delves into the nuances of health insurance options, shedding light on the best path forward for small businesses and their employees.

Overview of Small Business Health Insurance

Small business health insurance refers to health coverage provided by small employers to their employees. This type of insurance helps employees access medical care and provides financial protection in case of illness or injury.Offering health insurance to employees in small businesses is important for several reasons.

Firstly, it helps attract and retain top talent by providing a valuable benefit that can set a small business apart from competitors. Additionally, offering health insurance can improve employee morale, productivity, and overall job satisfaction.Providing health insurance coverage for small business owners and employees comes with numerous benefits.

It can lead to a healthier workforce, reduced absenteeism, and improved employee loyalty. Health insurance coverage also helps protect employees from high medical costs, ensuring they can access necessary healthcare without facing financial hardship.

Group Health Insurance Plans

Group health insurance plans are policies purchased by employers to provide healthcare coverage to their employees. These plans offer coverage to a group of people, typically employees of a company, and are often more cost-effective compared to individual health insurance plans due to the risk being spread out among a larger pool of individuals.

Cost-Effectiveness of Group Health Insurance Plans

Group health insurance plans are generally more affordable for small businesses compared to individual plans because the risk is spread across a larger group of employees. This can lead to lower premiums and better coverage options for employees. Additionally, employers can deduct the cost of providing health insurance for employees as a business expense, making it a tax-deductible benefit.

- Group health insurance plans also often come with lower deductibles and out-of-pocket costs for employees, making healthcare more accessible and affordable.

- Employers can negotiate better rates with insurance providers when purchasing group health insurance plans, further reducing costs.

Examples of Group Health Insurance Providers for Small Businesses

Some examples of group health insurance providers that offer plans for small businesses include:

- UnitedHealthcare: Offers a range of group health insurance plans with customizable options to meet the needs of small businesses.

- Anthem Blue Cross: Provides group health insurance plans with various coverage options and networks to choose from.

- Kaiser Permanente: Offers integrated healthcare plans for small businesses, including medical services, pharmacy coverage, and wellness programs.

Individual Health Insurance Plans

Individual health insurance plans are policies purchased by individuals to cover their own medical expenses. These plans are not tied to an employer and are typically chosen based on personal needs and preferences.

Flexibility and Customization Options

Individual health insurance plans offer a high level of flexibility and customization. Policyholders can select the coverage options that best suit their needs, such as deductibles, copayments, and specific healthcare providers.

- Policyholders have the freedom to choose their own doctors and specialists without restrictions.

- Individuals can tailor their plans to include specific benefits like maternity care or mental health services.

- Flexibility in selecting coverage limits and cost-sharing arrangements according to personal preferences.

Advantages and Disadvantages for Small Business Owners and Employees

Individual health insurance plans have both advantages and disadvantages for small business owners and employees.

- Advantages:

- Portability: Individuals can keep their coverage even if they change jobs or start their own businesses.

- Customization: Policies can be tailored to meet specific healthcare needs and budget constraints.

- Choice: Individuals have the freedom to select the insurance carrier and plan that best fits their requirements.

- Portability: Individuals can keep their coverage even if they change jobs or start their own businesses

- Disadvantages:

- Cost: Individual plans may be more expensive than group plans due to the lack of employer contributions.

- Limited Coverage: Some individual plans may have restrictions on coverage for pre-existing conditions or certain treatments.

- Administrative Burden: Managing individual plans for multiple employees can be time-consuming for small business owners.

Factors to Consider When Choosing Between Group and Individual Plans

When deciding between group and individual health insurance plans for your small business, there are several key factors to take into consideration. These factors include cost, coverage options, administrative requirements, and employee preferences. It's important to carefully evaluate these aspects to make an informed decision that aligns with your company's needs and budget.

Cost

- Group Plans: Typically more cost-effective as the risk is spread across a larger pool of employees.

- Individual Plans: Can be more expensive due to the personalized nature of coverage.

Coverage Options

- Group Plans: Often offer a wider range of coverage options, including medical, dental, and vision.

- Individual Plans: May have more limited coverage options and require additional policies for comprehensive coverage.

Administrative Requirements

- Group Plans: Require more administrative work to manage enrollment, changes, and compliance with regulations.

- Individual Plans: Generally have fewer administrative requirements, making them easier to handle for small businesses with limited resources.

Employee Preferences

- Group Plans: Employees may prefer group plans for the added benefits and cost savings.

- Individual Plans: Some employees may prefer individual plans for more personalized coverage options.

Company Size and Budget

Consider the size of your company and budget constraints when choosing between group and individual plans. Larger companies with more employees may benefit from the cost savings of group plans, while smaller businesses may find individual plans more manageable and cost-effective.

Closing Notes

In conclusion, the choice between Small Business Health Insurance Group and Individual Plans hinges on various factors that impact both businesses and employees. By understanding the differences and benefits of each option, businesses can make informed decisions to ensure the well-being of their workforce.

FAQ Summary

What are the key differences between group and individual health insurance plans?

Group health insurance plans are typically offered through an employer to a group of employees, providing coverage for all members. Individual health insurance plans are purchased by individuals to cover themselves and their families.

How do the costs compare between group and individual health insurance plans?

Group health insurance plans are often more cost-effective for small businesses as the risk is spread across a larger group. Individual plans may offer more customization but can be pricier.

What factors should businesses consider when choosing between group and individual health insurance plans?

Businesses should consider factors like cost, coverage options, administrative requirements, and employee preferences when deciding between group and individual health insurance plans.