Delving into the realm of Employee Health Insurance Benefits for Small Companies, we uncover the pivotal role these benefits play in the well-being of employees and the success of businesses. From enhancing morale to aiding recruitment, the impact is profound and multifaceted.

As we navigate through the nuances of health insurance options, legal requirements, cost management strategies, and employee education, a tapestry of insights emerges to guide small companies towards informed decisions.

Importance of Offering Employee Health Insurance Benefits

Providing health insurance benefits for employees in small companies is crucial for various reasons. It not only ensures the well-being of the employees but also has a significant impact on the overall success of the business.Employee health insurance benefits can enhance employee morale, as it shows that the company cares about their well-being and values them as essential assets.

This, in turn, can lead to higher job satisfaction, increased loyalty, and improved retention rates. When employees feel supported and valued, they are more likely to stay with the company for the long term.Moreover, offering health insurance benefits can also attract top talent during the recruitment process.

Job seekers often prioritize companies that provide comprehensive benefits packages, including health insurance. By offering this perk, small companies can compete with larger corporations and attract skilled professionals to join their team.Additionally, providing health insurance benefits contributes to creating a positive work culture within the company.

Employees who feel secure about their health and well-being are more likely to be engaged, motivated, and productive. A healthy workforce leads to fewer sick days, lower healthcare costs, and overall higher productivity levels.Overall, offering employee health insurance benefits is a win-win situation for both the employees and the company.

It promotes a healthy and happy work environment, improves employee satisfaction and retention, attracts top talent, and ultimately contributes to the overall success and growth of the business.

Types of Health Insurance Plans for Small Companies

When it comes to providing health insurance benefits for employees in small companies, there are several options to choose from. Each type of health insurance plan has its own features, costs, and benefits. Let's explore the different health insurance options available for small businesses.

Traditional Health Insurance

Traditional health insurance plans involve a fee-for-service model where employees have the flexibility to choose their healthcare providers. These plans typically have higher premiums but offer greater freedom in selecting doctors and specialists.

Health Maintenance Organizations (HMOs)

HMOs are known for their cost-effective approach to healthcare. Employees are required to choose a primary care physician who manages their care and provides referrals to specialists within the network. HMOs usually have lower premiums and out-of-pocket costs but require employees to stay within the network for coverage.

Preferred Provider Organizations (PPOs)

PPOs offer a balance between flexibility and cost savings. Employees have the option to see any healthcare provider, but they can save money by using in-network doctors and hospitals. PPOs typically have higher premiums than HMOs but provide more freedom in choosing healthcare providers.

High-Deductible Health Plans (HDHPs)

HDHPs come with lower premiums but higher deductibles compared to traditional plans. These plans are often paired with Health Savings Accounts (HSAs) or Health Reimbursement Arrangements (HRAs) to help employees cover out-of-pocket expenses. HDHPs are designed to encourage cost-conscious healthcare decisions.In all these health insurance plans, employees may encounter various cost-sharing mechanisms such as premiums, deductibles, and copayments.

Premiums are the monthly payments made to the insurance company, while deductibles are the amount employees must pay out of pocket before the insurance kicks in. Copayments are fixed fees that employees pay for each visit or service. Understanding these cost-sharing mechanisms is crucial for employees to make informed decisions about their healthcare coverage.

Legal Requirements and Compliance

Small companies are legally obligated to offer health insurance benefits to their employees in certain situations. The Affordable Care Act (ACA) has specific requirements that small employers must adhere to in order to remain compliant with the law. Failure to comply with these regulations can result in severe consequences for the company.

Affordable Care Act (ACA) Requirements for Small Employers

The ACA requires small employers with 50 or more full-time equivalent employees to offer affordable health insurance coverage that meets minimum essential coverage requirements. Failure to provide this coverage can result in penalties for the employer. Additionally, employers are required to report information about the health insurance coverage they offer to the IRS and their employees.

Consequences of Non-Compliance with Health Insurance Regulations

Non-compliance with health insurance regulations can lead to significant financial penalties for small companies. These penalties can add up quickly and have a detrimental impact on the company's bottom line. In addition to financial penalties, non-compliance can also damage the company's reputation and make it difficult to attract and retain top talent.

It is essential for small companies to understand and comply with health insurance regulations to avoid these negative consequences.

Cost Management Strategies for Small Companies

Managing the costs of providing health insurance benefits can be challenging for small businesses. Here are some strategies to help small companies handle these costs effectively.

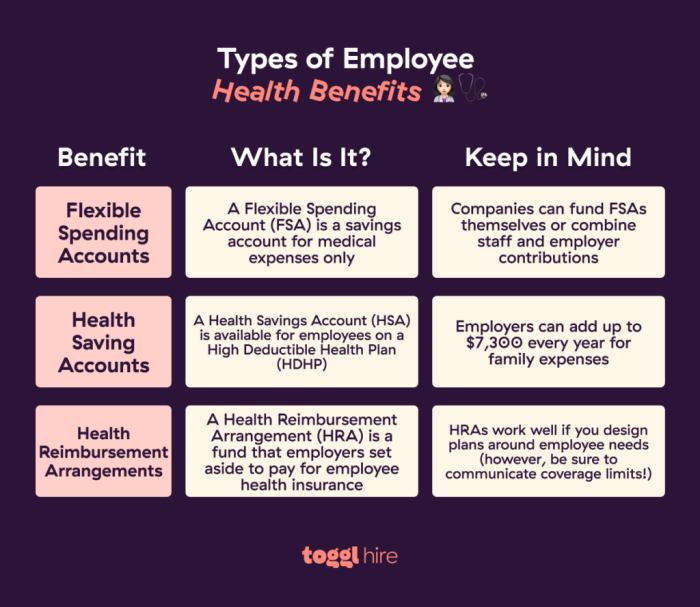

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

- Health Savings Accounts (HSAs) allow employees to set aside pre-tax dollars to cover qualified medical expenses. These funds roll over from year to year, making them a valuable long-term savings tool.

- Flexible Spending Accounts (FSAs) also enable employees to use pre-tax dollars for medical expenses but have a "use it or lose it" rule, meaning funds must be used within the plan year or forfeited. Both HSAs and FSAs can help employees manage healthcare costs efficiently.

Negotiating with Insurance Providers and Leveraging Tax Incentives

- Small companies can negotiate with insurance providers to secure better rates and customized plans that meet their budgetary needs. Exploring multiple options and comparing quotes can help in finding the most cost-effective insurance coverage.

- Leveraging tax incentives such as the Small Business Health Care Tax Credit can provide financial relief to small companies offering health insurance benefits. Understanding and utilizing these incentives can help offset the costs of providing coverage to employees.

Employee Education and Communication

Educating employees about their health insurance benefits is crucial for ensuring they understand the coverage and utilize the plans effectively. Effective communication strategies can help employees make informed decisions about their health benefits, leading to better health outcomes and overall satisfaction.

Importance of Employee Education

Providing clear and concise information about health insurance benefits empowers employees to make the most of their coverage. By understanding the details of their plan, employees can take advantage of preventative care services, manage chronic conditions, and navigate healthcare costs more effectively.

Strategies for Effective Communication

- Host informational sessions or workshops to explain plan details and coverage options.

- Create easily accessible resources such as FAQs, brochures, and online portals for employees to reference.

- Utilize personalized communication methods such as email updates, newsletters, and one-on-one consultations.

Resources and Tools for Informed Decision-Making

Employees can benefit from various resources and tools to help them navigate their health insurance benefits:

Healthcare cost calculators can help employees estimate out-of-pocket expenses for different medical services.

Provider directories can assist employees in finding in-network healthcare providers for cost-effective care.

Wellness programs and online health assessments can encourage employees to engage in healthy behaviors and preventive care.

Wrap-Up

In conclusion, Employee Health Insurance Benefits for Small Companies serve as a cornerstone for fostering a healthy, motivated workforce. By understanding the intricacies of providing these benefits, companies can not only comply with legal obligations but also create a positive work environment that nurtures productivity and employee satisfaction.

FAQ Compilation

What are the key advantages of offering health insurance benefits to employees?

Providing health insurance benefits can boost employee morale, aid in retention, and attract top talent during recruitment.

What are some cost management strategies small companies can implement for health insurance benefits?

Small companies can explore options like health savings accounts (HSAs), flexible spending accounts (FSAs), and negotiate with insurance providers to manage costs effectively.

How can small companies ensure compliance with legal requirements when offering health insurance benefits?

Small companies need to understand the Affordable Care Act (ACA) requirements and ensure they comply with regulations to avoid consequences of non-compliance.