Employee Health Insurance Premiums: How to Lower Your Costs becomes the focal point of discussion in this captivating piece, drawing readers in with a wealth of information presented in a polished and engaging manner.

The subsequent paragraph will delve into the specifics of the topic, providing a comprehensive overview.

Understanding Employee Health Insurance Premiums

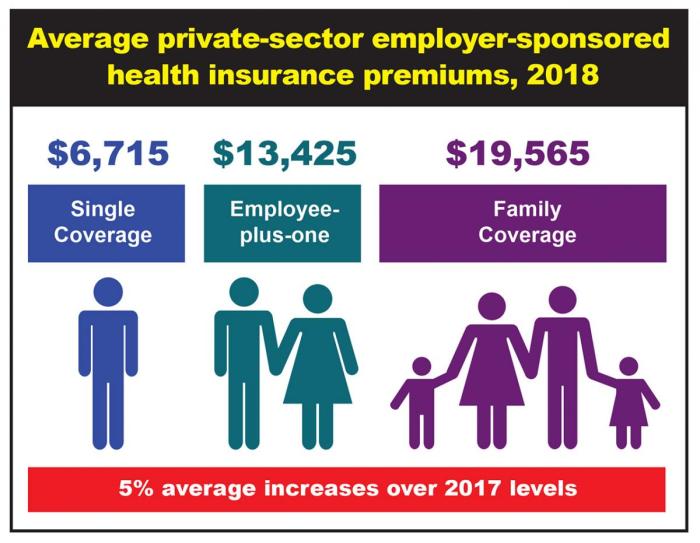

Employee health insurance premiums are influenced by various factors, including the type of coverage, the number of employees covered, the location of the business, and the age and health status of the employees. These factors can impact the overall cost of health insurance for both employers and employees.

Factors Affecting Premium Costs

- The type of coverage: Health insurance plans with more comprehensive coverage, such as lower deductibles and copayments, tend to have higher premiums.

- The number of employees covered: Group health insurance plans that cover a larger number of employees may result in lower premiums per employee.

- Location of the business: Health insurance premiums can vary based on the geographic location of the business, as healthcare costs can differ significantly between regions.

- Age and health status of employees: Older employees or those with pre-existing medical conditions may lead to higher premiums, as they are considered higher risk.

Calculation of Premiums

Employee health insurance premiums are typically calculated based on the total cost of providing coverage for all employees in a group. Insurance companies consider the overall risk profile of the group, taking into account factors such as age, gender, location, and past medical history.

Premiums are then determined based on this risk assessment and the level of coverage selected by the employer.

Impact of Coverage Types

- Health Maintenance Organization (HMO) plans: HMOs typically have lower premiums but require employees to use a network of healthcare providers.

- Preferred Provider Organization (PPO) plans: PPOs offer more flexibility in choosing healthcare providers but often come with higher premiums.

- High Deductible Health Plans (HDHPs): HDHPs have lower premiums but higher deductibles, making them more suitable for healthier employees who don't anticipate frequent medical expenses.

Strategies to Lower Employee Health Insurance Premiums

Promoting employee wellness programs is crucial in reducing insurance costs. By encouraging healthy habits and preventive care among employees, companies can lower the risk of expensive medical treatments, ultimately leading to lower premiums for the organization.

Negotiating with Insurance Providers

When negotiating with insurance providers, it is important to gather data on employee health and claims history to present a strong case for lower rates. Companies can leverage this information to negotiate for better premiums based on the health profile of their workforce.

- Research different insurance providers and compare rates to ensure you are getting the best deal for your employees.

- Consider bundling insurance plans or offering a multi-year contract to potentially secure lower premiums.

- Highlight any wellness initiatives or programs your company has in place to demonstrate a proactive approach to employee health.

High-Deductible Health Plans

Offering high-deductible health plans (HDHPs) can be an effective strategy to lower premiums while still providing coverage for employees. HDHPs typically come with lower monthly premiums but higher deductibles, encouraging employees to be more cost-conscious when seeking medical care.

- Educate employees on how HDHPs work and the potential cost savings associated with them.

- Provide resources such as health savings accounts (HSAs) to help employees cover out-of-pocket expenses associated with high deductibles.

- Encourage employees to take advantage of preventive care services that are often covered at no cost under HDHPs to maintain their health and reduce overall healthcare costs.

Exploring Cost-Saving Options for Employers

When it comes to lowering employee health insurance premiums, employers have a variety of cost-saving options to consider

Alternative Insurance Models: Self-Funded Plans

Self-funded health insurance plans are becoming increasingly popular among employers looking to lower premium costs. In a self-funded plan, the employer assumes the financial risk for providing healthcare benefits to employees, rather than paying fixed premiums to an insurance carrier.

By self-insuring, employers can potentially save money on administrative costs and have more control over the benefits offered.

Role of Health Savings Accounts (HSAs)

Health savings accounts (HSAs) play a crucial role in lowering overall healthcare expenses for employers and employees alike. HSAs are tax-advantaged savings accounts that can be used to pay for qualified medical expenses. By pairing a high-deductible health plan (HDHP) with an HSA, employers can help employees save money on premiums while encouraging them to take a more active role in managing their healthcare costs.

Cost-Sharing Strategies Between Employers and Employees

Implementing cost-sharing strategies can help reduce premiums for both employers and employees. For example, employers can offer wellness programs to promote healthy lifestyles among employees, leading to lower healthcare costs overall. Additionally, sharing the cost of premiums with employees through contributions or deductibles can help offset rising healthcare expenses.

Legal Considerations and Compliance

When it comes to providing health insurance to employees, there are several legal requirements that employers need to be aware of. Compliance with regulations such as the Affordable Care Act (ACA) can have a significant impact on premium costs and overall healthcare benefits for employees.

Additionally, understanding the tax implications related to offering health insurance benefits is crucial for both employers and employees.

Legal Requirements for Providing Health Insurance

- Employers with 50 or more full-time employees are required to offer health insurance coverage that meets certain minimum standards under the ACA.

- Employers must also comply with state-specific regulations regarding health insurance coverage for employees.

- Providing accurate information to employees about their health insurance options and rights is essential for legal compliance.

Compliance with Affordable Care Act (ACA)

- Failure to comply with ACA regulations can result in penalties for employers, impacting premium costs and overall financial stability.

- Employers must ensure that health insurance plans meet essential health benefits and affordability standards set forth by the ACA.

- Tracking and reporting employee health insurance coverage to the IRS is necessary to demonstrate compliance with the ACA.

Tax Implications of Offering Health Insurance Benefits

- Employers can generally deduct the cost of providing health insurance benefits to employees as a business expense.

- Employees' contributions to health insurance premiums are typically made on a pre-tax basis, reducing their taxable income.

- Employers should be aware of tax credits and incentives available for offering health insurance benefits to employees, which can help offset costs.

Ultimate Conclusion

Concluding this discussion on Employee Health Insurance Premiums: How to Lower Your Costs, the final paragraph encapsulates key points in a compelling manner, leaving readers with a lasting impression.

Commonly Asked Questions

How can promoting employee wellness programs help reduce insurance costs?

Promoting employee wellness programs can lead to healthier employees, thereby reducing insurance claims and ultimately lowering insurance costs.

What are self-funded insurance plans and how do they impact premium costs?

Self-funded insurance plans involve the employer bearing the financial risk for providing healthcare benefits to employees, potentially offering cost-saving benefits compared to traditional insurance models.

How do high-deductible health plans help in lowering premiums?

High-deductible health plans typically have lower premiums, making them an attractive option for both employers and employees looking to reduce healthcare costs.