Exploring the realm of Live in Home Care Near Me with Insurance Coverage, this introduction sets the stage for a detailed exploration of the topic. Providing valuable insights and essential information, this overview aims to captivate readers' interest from the get-go.

Detailing the significance and nuances of insurance coverage for live-in home care, this introductory paragraph establishes a solid foundation for the discussion ahead.

Researching Live-in Home Care Providers

When looking for live-in home care providers, it is essential to do thorough research to ensure you find the right fit for your needs. This involves identifying the top providers in your area, comparing insurance coverage offered by different providers, and considering key factors to make an informed decision.

Identify Top Live-in Home Care Providers

- Ask for recommendations from healthcare professionals, friends, or family members who have experience with live-in home care.

- Check online reviews and ratings of different providers to get an idea of their reputation and quality of service.

- Contact local agencies or organizations specializing in senior care to get a list of recommended providers in your area.

Compare Insurance Coverage Offered

- Review the insurance policies of each provider to understand what is covered and any out-of-pocket expenses you may incur.

- Consider whether the insurance coverage includes services such as medication management, personal care, and medical appointments.

- Compare the cost of insurance premiums and deductibles to determine the most cost-effective option for your budget.

Key Factors to Consider

- Experience and qualifications of caregivers, including background checks and training.

- Availability of 24/7 support and emergency services.

- Personalized care plans tailored to the individual's needs and preferences.

- Flexibility in scheduling and the ability to accommodate changes in care needs.

- Communication and transparency in billing, insurance coverage, and care updates.

Understanding Insurance Coverage for Home Care

Insurance coverage plays a crucial role in ensuring that individuals receive the necessary care and support they need in the comfort of their own homes. It provides financial protection and peace of mind to both the individuals receiving care and their families.

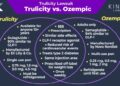

Types of Insurance for Home Care Services

- Medicare: Medicare may cover certain home health care services for individuals who meet specific criteria, such as being homebound and requiring skilled nursing care.

- Medicaid: Medicaid provides coverage for home and community-based services for eligible individuals with low income and limited resources.

- Private Health Insurance: Some private health insurance plans offer coverage for home care services, including live-in home care, depending on the policy and provider.

Insurance Companies Offering Coverage for Live-in Home Care

- UnitedHealthcare: UnitedHealthcare offers a variety of insurance plans that may cover live-in home care services for eligible individuals.

- Aetna: Aetna provides insurance coverage for home care services, including live-in care, under certain plans and policy options.

- Cigna: Cigna offers insurance plans that may include coverage for live-in home care for individuals who require assistance with daily activities.

Qualifying for Insurance Coverage

When it comes to live-in home care, understanding if your insurance plan covers these services is crucial. Let's dive into the eligibility criteria and tips for verifying insurance coverage.

Eligibility Criteria for Insurance Coverage

- Insurance coverage for live-in home care may be available for individuals who have a medical need for assistance with activities of daily living.

- Some insurance plans may require a doctor's prescription or recommendation for home care services to be covered.

- Certain insurance providers may have specific criteria related to the type and duration of care needed for coverage.

Determining if Your Insurance Plan Covers Home Care Services

- Review your insurance policy documents or contact your insurance provider to understand what home care services are covered.

- Look for specific language related to home care coverage, including any limitations or exclusions that may apply.

- Consider scheduling a consultation with a representative from your insurance company to discuss coverage options for live-in home care.

Verifying Insurance Coverage for Home Care

- Contact your insurance provider to inquire about coverage for live-in home care services.

- Provide any necessary documentation, such as a doctor's prescription or recommendation, to support your request for coverage.

- Ask about the process for submitting claims for home care services and any requirements for pre-approval or authorization.

Financial Planning for Live-in Home Care

When considering live-in home care services, it is important to develop a financial plan to ensure that you can afford the necessary care. This involves organizing a budget that takes into account insurance coverage for home care and strategies for managing out-of-pocket expenses effectively.

Designing a Financial Plan

Creating a financial plan to afford live-in home care services involves assessing your current financial situation, estimating the cost of care, and identifying potential funding sources. Consider factors such as your income, savings, investments, and any existing insurance coverage that may help offset the costs.

Organizing a Budget with Insurance Coverage

- Review your insurance policy to understand what home care services are covered and the extent of coverage provided.

- Calculate the out-of-pocket expenses that you will need to cover after insurance reimbursement.

- Allocate funds in your budget specifically for home care costs, taking into account both insurance coverage and personal contributions.

- Regularly review and adjust your budget as needed to ensure that you can continue to afford the necessary care.

Managing Out-of-Pocket Expenses

While insurance coverage can help offset some of the costs of live-in home care, there may still be out-of-pocket expenses that you need to manage. Consider the following strategies:

- Explore alternative funding sources such as Medicaid, Veterans benefits, or long-term care insurance.

- Utilize tax-advantaged accounts like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) to pay for eligible home care expenses.

- Consult with a financial advisor to explore options for maximizing your resources and minimizing out-of-pocket costs.

Concluding Remarks

In conclusion, Live in Home Care Near Me with Insurance Coverage offers a vital support system for individuals in need of consistent care. By understanding the intricacies of insurance coverage and financial planning, one can navigate this aspect of home care with confidence and ease.

Detailed FAQs

What types of insurance typically cover home care services?

Insurance policies such as long-term care insurance, Medicaid, and some private health insurance plans often cover home care services.

How can I determine if my insurance plan covers home care services?

You can reach out to your insurance provider directly to inquire about the specifics of your coverage for home care services.

What are some strategies for managing out-of-pocket expenses for home care services?

Exploring options such as government assistance programs, community resources, and financial planning can help in managing out-of-pocket expenses for home care services.